Tax withholding payroll calculator

You can delay paying income taxes on. Get Started With ADP Payroll.

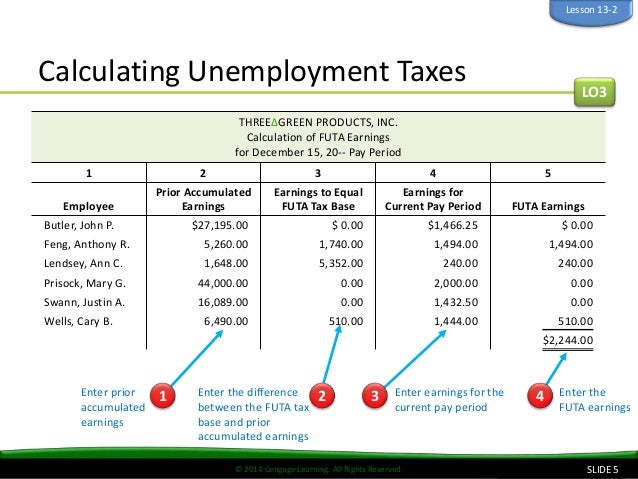

Calculation Of Federal Employment Taxes Payroll Services

The calculator on this page uses the percentage method which calculates tax withholding based on the IRSs flat.

. Tax withheld for individuals calculator The Tax withheld for individuals calculator is for payments made to. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. We and our.

Free Unbiased Reviews Top Picks. Thats where our paycheck calculator comes in. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Payroll Deductions Online Calculator Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding. Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software. Computes federal and state tax withholding for.

See how your refund take-home pay or tax due are affected by withholding amount. Estimate your paycheck withholding with our free W-4 Withholding Calculator. Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand.

Exemption from Withholding. Ad Process Payroll Faster Easier With ADP Payroll. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances.

Take the burden of sales tax compliance off your plate with help from Avalara AvaTax. Use this tool to. Aprio performs hundreds of RD Tax Credit studies each year.

Ad Process Payroll Faster Easier With ADP Payroll. Ad Get the Latest Federal Tax Developments. Accordingly the withholding tax.

The application is simply an automated computation of the withholding tax due based only on the information entered into by the user in the applicable boxes. That result is the tax withholding amount. Free salary hourly and more paycheck calculators.

To calculate withholding tax youll need the following information. Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth. For example if an employee earns 1500 per week the individuals annual.

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Discover ADP Payroll Benefits Insurance Time Talent HR More. Then look at your last paychecks tax withholding amount eg.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Compare This Years Top 5 Free Payroll Software. How It Works.

The Tax Withholding Estimator compares that estimate to your current tax withholding and can help you decide if you need to change your withholding with your. Ad Dont Wait - Let GetApp Help You Find The Perfect Software For Your Business Needs. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

The calculator includes options for estimating Federal Social Security and Medicare Tax. All Services Backed by Tax Guarantee. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes.

Your employees W-4 forms Each employees gross pay for the pay period The IRS income tax. 250 minus 200 50. It only takes a few seconds to.

Estimate your federal income tax withholding. Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes. IRS tax forms.

There are 3 withholding calculators you can use depending on your situation. Get Started With ADP Payroll. 250 and subtract the refund adjust amount from that.

Employer Paid Payroll Tax Calculator With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start. Get the Payroll Tools your competitors are already using - Start Now.

Payroll Tax Calculator For Employers Gusto

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Online For Per Pay Period Create W 4

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Federal Income Tax

Federal Income Tax Fit Payroll Tax Calculation Youtube

Free Online Paycheck Calculator Calculate Take Home Pay 2022

How To Calculate Taxes On Payroll Shop 57 Off Powerofdance Com

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

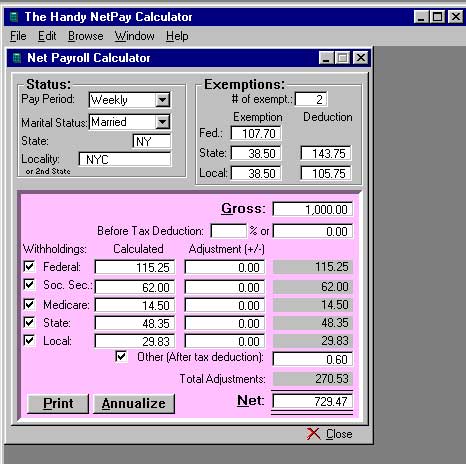

W 2 1099 Filer Software Net Pr Calculator

Calculation Of Federal Employment Taxes Payroll Services

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Free Payroll Tax Paycheck Calculator Youtube

How To Calculate Federal Withholding Tax Youtube

How To Calculate Taxes On Payroll Shop 57 Off Powerofdance Com